The Industry experts are hailing the corporate income tax rate cuts in India from 30% to 22% as one of the boldest moves. India’s stock market went on a rampage and surged more in a single day than it ever did in the last ten years.

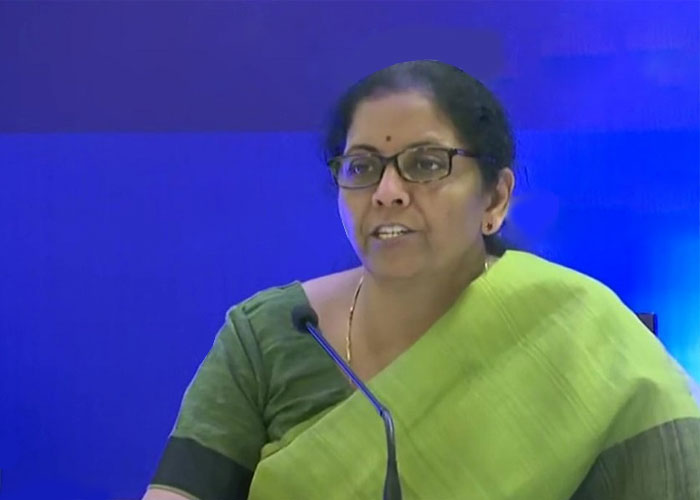

The Sensex skyrocketed over 1,921 points on Friday after Nirmala Sitharaman, Finance Minister of India, announced major relief and incentives for the economy. The Sensex closed at 38,014.62 on 20th September gaining over 5.35%. The Nify gained 569.4 points to end at 5.32%. The market clearly responded positively to the corporate tax cut announcements.

The effective corporate tax rate after including surcharge & cess would be 25.17%. The benefits will be available to all domestic companies not availing exemptions & government incentives.

Boost across Sectors

The corporate tax rate cut will be effective from 1st April 2019. This means companies which have already paid advance taxes will get refunds from the government. The cashflow for companies will be helpful in various sectors.

The finance minister announced further rebates for new domestic companies incorporated in India after 1st October 2019, these companies will pay income tax at 15%. The effective rate income tax rate after surchage and cess would be 17%. These companies will need to start their product before 31st March 2023 though.

India as an Investment Destination

Singapore has been one of the most favorite destinations for investors, it has a corporate tax of 17%. China & Korea have a corporate tax of 25%. India now has a tax rate on par with the lowest in South East Asia. UK has a corporate income tax of 19%, USA 27%, Japan & Germany 30% & Brazil 34%.

The tax rebates are likely to increase the investments and make India one of the most attractive destinations for investors. With a serviced based economy, India is likely to benefit from this rate cut by projecting itself as a manufacturing hub. India is home to a huge and skilled workforce as well.

Business Leaders Welcome the Move

The increased earnings for companies in India due to reduced tax outgo will make the investors happy. The automobile sector in India may pass some of the benefits to the customers with discounts in the festive season. The slowdown in the automobile sector has been an area of concern and these steps will go a long way to resurrect things.

Mahindra group Chairman, Anand Mahindra welcomed the move by the Finance Minister. He tweeted,

“Woke up in the US to this news. The best way to start the day. Not only because companies will pay less tax. But because this isn’t just another policy tweak. @nsitharaman fired a shot that will be heard around the world. India has sent an invitation letter to global investors,”

After the rate cut announcement, several business leaders including Kiran Mazumdar Shaw, CMD, Biocon, have expressed their pleasure at the move.

“Corporate Tax Rate Cut From 30% To 25.2% To Spur Growth- this is a great move which will firmly revive growth n investment. My hats off to FM @nsitharaman for this bold but most needed move.”

“Money available for reinvestment and paying better dividend will be there. You can plough back money and make the company stronger because only 25 percent goes in taxes. It is a great boon.” said Deepak Parekh, Chairman, HDFC

The announcements by government have had a strong impact on the Indian markets and overall sentiment is quite positive. It looks like Diwali has come early for the Indian corporates.

The announcements by government have had a strong impact on the Indian markets and overall sentiment is quite positive. It looks like Diwali has come early for the Indian corporates.